Yesterday the Fed released the minutes from the FOMC’s July meeting. There were few surprises, but two things really stood out; members are anxious about inflation and they’re anxious about a recession.

As you will read below, this is good news for the gold price and anyone who has already decided to invest in gold.

This might sound odd as generally an increase in interest rates is believed to be bad news for those who own gold bars or coins, but actually, history shows that when central bankers and governments get nervous about the economy then we are set to see a positive environment for gold and silver prices.

Jim Rickards and Gareth Soloway on Metals, Markets and Money

The economic cycle never stands still. In fact, the global economy is such a tricky thing to comprehend we almost pity the central bankers who believe any effective control over the economy is possible! Needless to say, they are once again wrong.

Central banks have been lifting interest rates to combat inflation. But those same interest rates have caused a recession. Or may it be fairer to say that recession had already begun before interest rates rose, but the bankers could not see the recession starting?

Either way the world is rolling over now from rising inflation fears into recession fears. Signs of recession setting in are popping in many data sources.

When will this recession end?

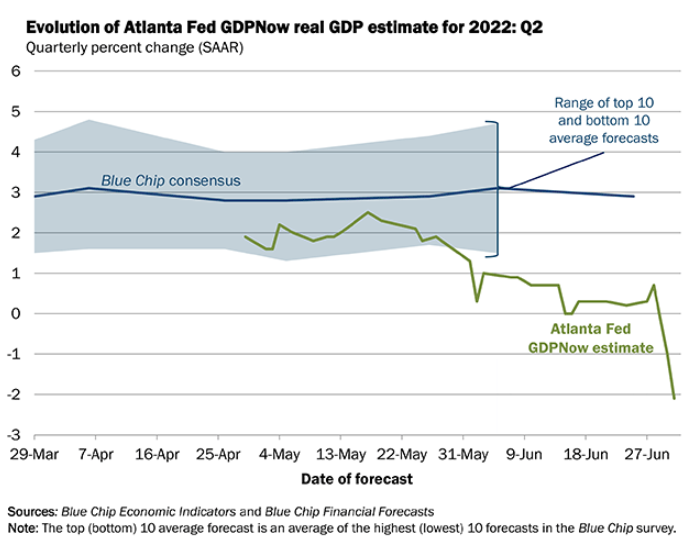

The U.S. is most likely in recession, which is two consecutive quarters of negative GDP growth. 2022’s first-quarter U.S. GDP growth came in at -1.6% and the Atlanta Fed’s GDPNow model currently estimates that second-quarter growth will be a negative 2.1%.

And since one definition of a recession is 6 months of negative growth…we are already in one and it began back in January – surprise!

The next big question is – when will this recession end? Followed by asking how deep will it get? Further questions will be about when central bankers decide to reverse course and lower the interest rates they just rose.

Remember the central bank playbook is quite a short document. They raise rates to fight inflation and lower rates to fight the recession. They continually ‘provide liquidity’ when not playing with interest rates.

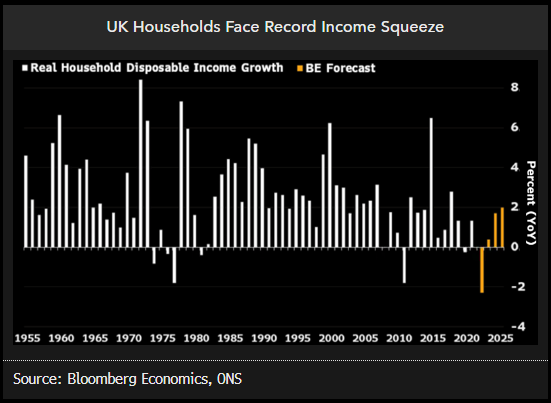

It’s not just the U.S. feeling the squeeze. Bloomberg reports that U.K. real household income is forecast to decline a record 2% this year.

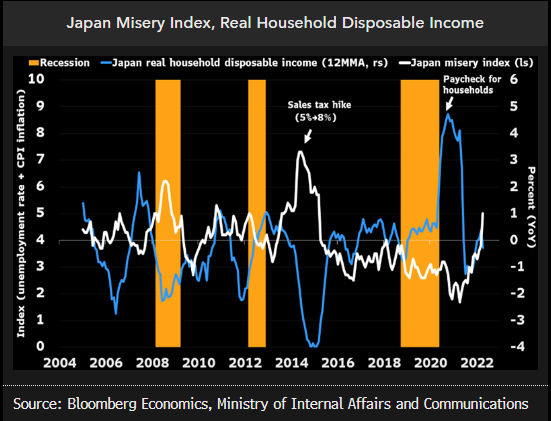

And growth is expected to decline for 2022 in Japan as real household disposable income declines and the misery index climbs.

The misery index is measured by the sum of the unemployment rate with the annual change in consumer price inflation.

The equity markets, with steep declines this year to date are reflecting that recession has already begun.

And bond yields are also signaling recession with 2024 interest rates lower than today’s rates. And even oil has declined to under US$100 this week because markets expect that consumers will fly less and drive less.

What does gold do during a recession?

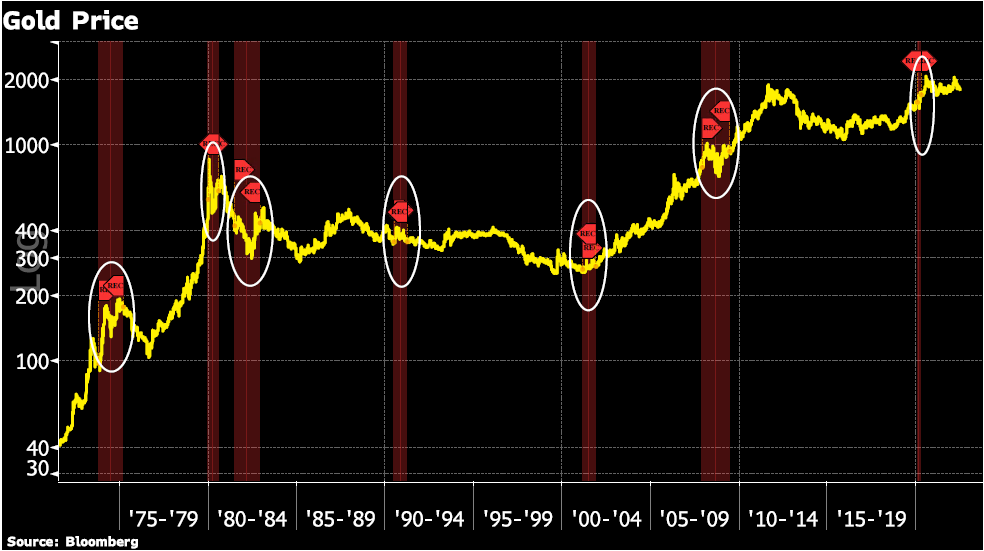

Recessions are not generally good for gold. But recession fighting by governments and central bankers is very positive for gold! Politicians always print money as a response to the recession and this time will be no different.

The continual growth of government printed money has accumulated for decades. This accumulation is why gold prices move ever higher over time.

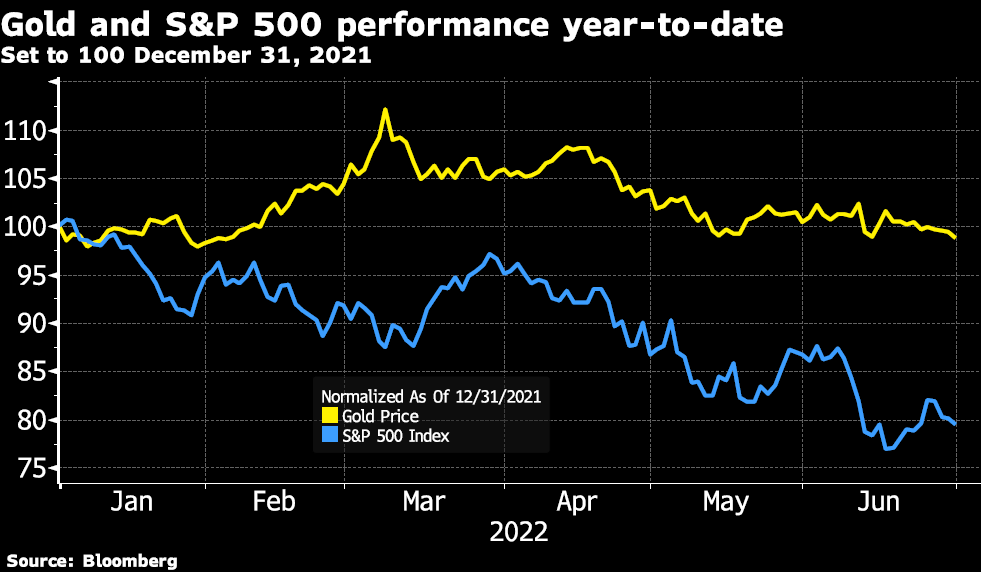

And even though gold and silver generally decline at the beginning of a recession a study put out by Bloomberg shows that since 1971, when then President Nixon ended the gold standard, that gold outperformed the S&P 500 for the two-year period surrounding recessions by 50% on average.

That two-year period is measured one year before the recession and one year after the recession.

The largest relative gain was the 1973-75 recession where gold outperformed the S&P 500 by almost 190%.

The relative gain during the 1980 recession was the second largest at almost 115%. The 1981-82 recession period and the 1990 recession period where the only two out of seven recessions that S&P 500 outperformed gold.

Looking at 2022’s current experience year-to-date gold; has held its value – while the S&P 500 has declined more than 20%.

This weekend we’re releasing the second episode of our hit new show The M3 Report. Presented by GoldCore’s Dave Russell, The M3 Report brings the viewer the best from GoldCore’s commentary and analysis, top guests, Chart Watch, and bonus clips from industry experts.

In Episode 2 Dave and the team take a cogent look at inflation and the dysfunctional relationship between it and the actions of central bankers.

We also have clips from our latest interview with Dr. Marc Faber, and Gareth Soloway brings us some brilliant chart analysis in Chart Watch.

And, have you ever wondered what you would do if you were Head of the Fed? We asked six of our favourite guests. Be sure to stay tuned to hear their answers!

If you haven’t already then make sure you’re subscribed to GoldCoreTV, so you’ll never miss an episode!

Click Here to Subscribe and Be Notified When it’s Live

From The Trading Desk

Market Update: Another week of poor economic data, Copper or sometimes referred to as ‘Dr. Copper’ has long been considered a valuable bellwether due to its multiple end-uses in several industries.

Copper is down 22% in a single month and currently trading at December 2020 levels.

This is a clear sign the global economy is starting to cool.

The Bank of England on Tuesday warned that the economic outlook for the UK and the rest of the world has ‘deteriorated materially’.

UK inflation is yet to peak with some forecasts it may do later in the year at close to 11%.

Gold came under pressure this week.

The initial sell-off was triggered by the strong move in the USD.

The USD broke through resistance and pushed the Euro to a two decade low against the greenback.

Unlike the Fed and the BOE who have already started to raise rates and look to tighten further, the ECB has yet to start with the first possible increase later this month at 25bp.

The Fed minutes released yesterday were extremely hawkish.

Fed officials saw a 50bps or 75bps hike at the July FOMC as likely (compare this to the ECB!).

Many FOMC members saw the significant risk of entrenched inflation.

These hawkish comments, gold sold off further to a low of $1,732 before a small bounce.

We are oversold here in the short term and the low may not be in for gold yet.

However, what we are seeing is clients taking advantage of these pullbacks to cost average and add to their existing allocations.

Stock Update

Silver Britannia offer UK – We have just taken delivery of 10,000 Silver Britannia’s at our London depository.

Available for storage in London or immediate delivery within the UK.

These are available at the lowest premium in the market (which includes VAT at 20%).

These can now be purchased online or contact our trading desk for more information.

Excellent stock and availability on all gold coins and bars.

Please contact our trading desk with any questions you may have.

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 37% for Silver Britannia’s 100oz and 1000oz bars are also available VAT free in Zurich starting at 8% for the 1000oz bars and 12.5% for the 100oz bars.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

06-07-2022 1766.65 1754.30 1479.92 1473.96 1727.08 1724.13

05-07-2022 1804.40 1772.00 1498.37 1482.46 1750.27 1728.05

04-07-2022 1807.05 1808.40 1491.72 1489.22 1730.97 1731.18

01-07-2022 1795.65 1797.45 1486.44 1499.43 1716.82 1731.12

30-06-2022 1813.60 1817.00 1495.13 1493.57 1739.42 1744.87

29-06-2022 1811.85 1817.75 1487.89 1499.64 1723.43 1733.41

28-06-2022 1827.00 1819.05 1488.82 1488.89 1725.97 1727.37

27-06-2022 1838.05 1826.30 1495.81 1486.79 1737.69 1725.49

24-06-2022 1826.50 1825.45 1484.94 1483.54 1730.79 1728.52

23-06-2022 1831.40 1841.90 1500.28 1499.12 1742.94 1746.31

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here