Football, love it or hate it, will dominate news outlets and Zoom small talk for the next month. Both the sport and the politics have entered the debating arenas, but there has been little mention of the whopping prize fund.

Yes, football is one of the world’s largest industries, but is the prize fund just because of the World Cup’s popularity, or is it really not so huge when you consider what has happened to the value of money? No wonder the solid gold trophy is the world’s most sought-after.

For this post, we take a break from the usual and discuss something near to many sports fans’ hearts – the FIFA World Cup!

Moreover, the World Cup will dominate sports fan attention spans over the next month. The opening match of the 2022 event was on November 20; Ecuador defeated the host country Qatar, which was the first time a host nation lost in the opening match.

It was also Qatar’s World Cup debut. It involves 32 teams at 6 different stadiums for a total of 64 matches. This will conclude with the championship game on December 18. In addition to the pure gold trophy, the winning team will be awarded $42 million in prize money.

Download Your Free Guide

Additionally, the trophy will be passed to the winning team from France, the 2018 winner. The trophy stands at 36.5 cm tall with a weight of only 6.2 kg, with approximately 2kg of that weight the malachite discs at the bottom.

The roughly 4.2 kg of gold would place the metal value (at US$235,000 at today’s price of gold. Amazingly 11 times the US$21,000 cost of that gold in 1974 when the current trophy was made.

Keep in mind this is the gold price only, the trophy’s estimate cost US$50,000 to make. Also, the estimated value has grown exponentially to more than that US$20 million making it the most valuable trophy in the world.

Correlation between The FIFA World Cup and Gold

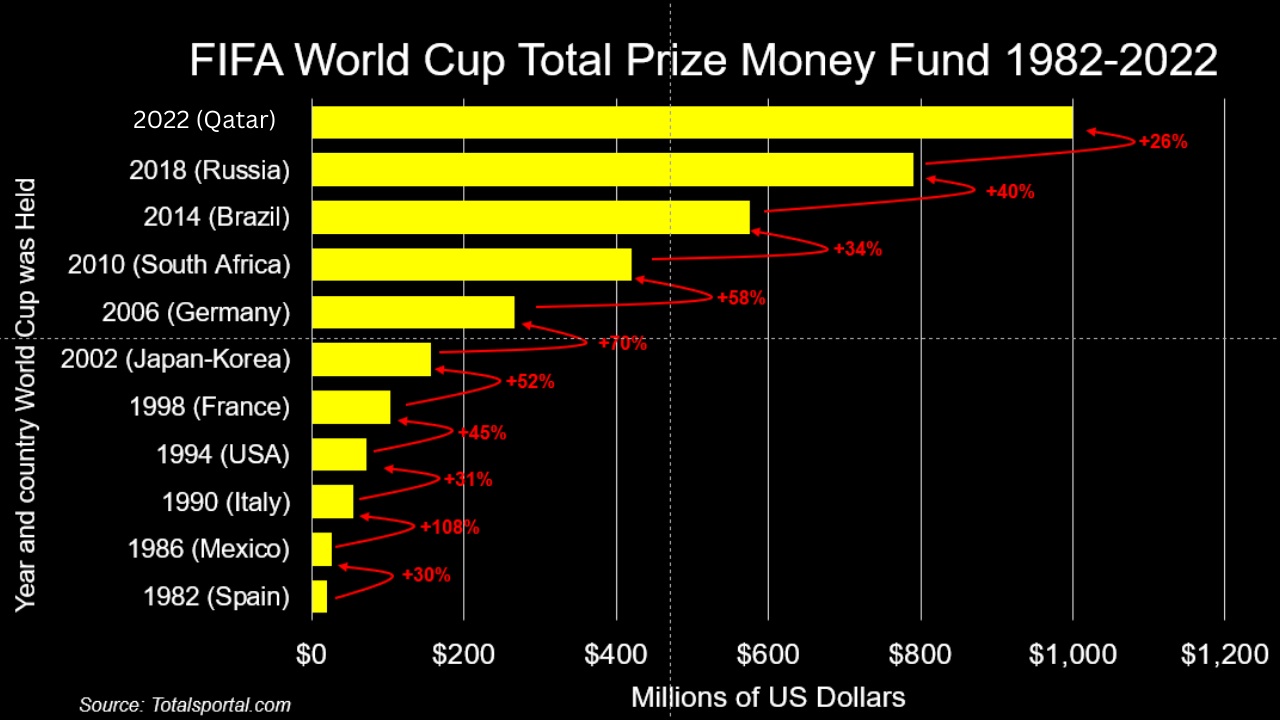

It is not only the value of the gold in the trophy that has increased over the last 48 years, but the total prize money for the FIFA World Cup has also increased substantially. As mentioned above, the winning team will get $42 million in prize money this year.

Each of the other 31 teams that participate are also awarded prize money. A total of US$440 million is being awarded this year. In addition, each team is awarded money for preparation, a club benefit programme, and a club protection programme (i.e., player’s insurance). This all adds up to a total prize money fund of US$1 billion, compared to the 2018 total of US$791 million.

The total prize money was $20 million in 1982. This was when FIFA first officially announced how much prize money each team would receive.

The increase in the Total Prize Money of US$209 million from the 2018 World Cup to this year’s US$1 billion total amount was the largest increase in actual dollars. However, in percentage terms, it was the smallest increase between events since the official prize was announced in 1982.

The largest percentage increase was the more than doubling (108% increase) from the 1982 World Cup held in Spain to the 1986 World Cup held in Mexico.

Moreover, there are 40 years between 1982 and 2022. During this time the prize pool grew from US$20 million to US$1 billion. If we calculate the annual rate of compound growth for something. This was over 40 years growing from 20 to 1,000 million, we get a 10.27% annual rate of growth.

Maybe this 10.27% inflation rate is a better representation of cost inflation than the government produced inflation indices? No one could ever definitively answer this question but it’s a great thing to ponder once your team exits (or wins!!) the tourney.

Correlation between The World Cup and Inflation

Come to think of this the 10.27% annual World Cup inflation rate is kind of close to the 7.96% inflation rate. If we calculate the price of gold over an even longer time frame.

Here is our math; gold was US$35 in 1971, and today gold is US$1740 in 2022 being 51 years later. 7.96% was the true inflation figure and growing broadcast rights explain the 2.31% extra growth in World Cup prize money.

Sporting prizes and salaries usually have much to do with business plans for broadcast growth. These do not directly link to official government inflation statistics. Yet to note that World Cup Total Prize packages grew at 10.27% annually. While the World Bank’s world consumer price inflation index has increased on average only half that amount at 5.32% since 1982.

How a Shortage of Rare Earth Metals Will Impact Us All

Those inflation rates seem very similar to us if you back out the growth in footie as the most popular human game. So, remember to go for gold by owning physical metals.

Bored of football talk? Worry not. We have a whole channel that has absolutely nothing to do with football, for you to enjoy. Check out GoldCore TV. Here we have a great selection of gold and silver market analysis, commentary and interviews. Great for those who fancy a break from football.

From The Trading Desk

Market Update

As the fallout from the recent FTX collapse and the risk of contagion within the Crypto industry spreads and values fall.

One thing that has become apparent with digital assets, is that to label them as currencies would be incorrect and how they have performed this year is more of an asset class than a currency.

Now, compare that to how gold and silver have performed in 2022, gold is up 5% in Euro terms and 8% in GBP terms, doing exactly what it should do to protect investors with the falling value of their currency.

Since gold is priced in USD there is a tendency just to look at how it is performing in USD. However, even looking at gold from a dollar perspective it is down 3% YOY but take into account the USD which has increased by over 15% this year.

There is a negative correlation that the USD has on the gold price, however, gold has held its own and has not sold off by an equivalent % amount.

The strong USD is holding it back for now in moving higher but as we have seen over the last month, when we see any weakness in the dollar, the Gold in USD terms pops.

Moreover, a quieter week on the markets with US Thanksgiving on Thursday, with US markets not open for full trading sessions.

Our trading hours Thursday 24th November are 7 pm GMT and Friday 25th November 6.30 pm GMT

Stock Update

Gold Brittania’s & Silver Brittania’s are available again for UK and Irish Investors. Gold Britannia’s start at 7.5% over Spot

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 38% for Silver Philharmonics.

We have Silver Britannia’s for immediate delivery in the UK at Spot plus 48%.

GoldCore have excellent stock and availability on all Gold Coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

22-11-2022 1747.00 1742.95 1473.59 1467.74 1698.78 1696.76

21-11-2022 1739.65 1740.40 1474.01 1471.86 1699.64 1696.02

18-11-2022 1764.75 1751.60 1481.15 1473.27 1702.63 1694.85

17-11-2022 1764.55 1758.60 1484.87 1491.64 1701.91 1701.62

16-11-2022 1783.20 1773.00 1494.86 1496.06 1709.91 1706.69

15-11-2022 1775.10 1771.35 1497.83 1483.15 1704.27 1702.27

14-11-2022 1757.35 1768.90 1491.46 1506.57 1704.98 1714.06

11-11-2022 1764.75 1759.35 1501.98 1498.26 1719.75 1710.09

10-11-2022 1705.65 1744.75 1498.93 1498.74 1714.69 1719.80

09-11-2022 1705.15 1715.25 1491.84 1501.87 1699.18 1707.19

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here