Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns.

As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the insurance that gold offers. However, it isn’t always the unknown or unseen that can cause damage to our wealth, sometimes it’s outright incompetence, as we discuss below.

What is wealth?

What is wealth? There are hundreds of definitions ranging from a wealth of happiness to a wealth of wisdom and even wealth of having lots of money. Only one definition matters for today’s discussion; wealth as felt by the mass of consumers inside western economies. Wealth is defined by the belief that:

a) an individual’s (or household’s) debts are smaller than their assets and;

b) assets greater than debts equal a positive net worth which can grow over time, and;

c) that any debts can easily be renewed as long as a positive net worth is maintained.

Yes, this is a complex definition but everything touching central banks is more complex than it needs to be.

‘Belief’ is the keyword for that definition. No consumer can see the future to know that in 10 years hence the value of their home will grow faster than the mortgage debt taken on to buy it [this is subsection b, above].

Yet, central bankers kept rates low for more than a decade to ensure everyone believed this to be true. In fact, a greater percentage of people believed it led to a greater amount of home buying. This is something that central bankers (and governments) are pleased with, and bankers call GDP growth.

Gold, Rate Hikes and The Central Bank Illusion?

Subsections a and c are tightly linked to interest rate decisions made by central bankers. For example, a) would break down if housing and stock prices were fairly counted within published inflation measures. When a central bank prints billions to support the stock market such printing never makes it into official measures of inflation, such as the Consumer Price Index. This kept the published inflation figures lower than they would have otherwise been over the last decade. Because the official inflation figure was reported lower, central banks kept interest rates lower. As seen in 2022 it is inflation that controls central bankers who in turn control interest rates. Subsection c) really means that no one who buys a house is afraid that when the mortgage comes due for renewal it cannot be remortgaged instead of becoming a forced seller through foreclosure.

So we have defined the three major things that consumers need to believe in order to think that they are wealthy. And we have shown that each of those is connected to central bank decisions.

The Wealth Effect

Here comes the first kicker this week: Out of fear of deflation central banks worldwide spent a decade monkeying with ways to make consumers feel wealthier. They lowered interest rates too far and kept them too low to chase something called ‘the wealth effect’. Here’s a quote from 2017 on Yahoo Finance wherein Jesse Felder plainly explains the ‘wealth effect’ bankers were trying to create.

Since the financial crisis nearly a decade ago, the Federal Reserve has printed trillions of dollars in an effort to create a “wealth effect” in the economy.

Their theory goes that quantitative easing would make for rising prices of financial assets. This should, in turn, make the wealthy feel more confident and thus spend more. By this process, a trickle-down effect would boost the economy.

In the decade from 2009 to 2019 Chair Bernanke, Yellen, Carney, and all the rest of the central banks chased the ‘wealth effect’ for the purpose of generating GDP growth. With also a little bit of inflation as defined by CPI.

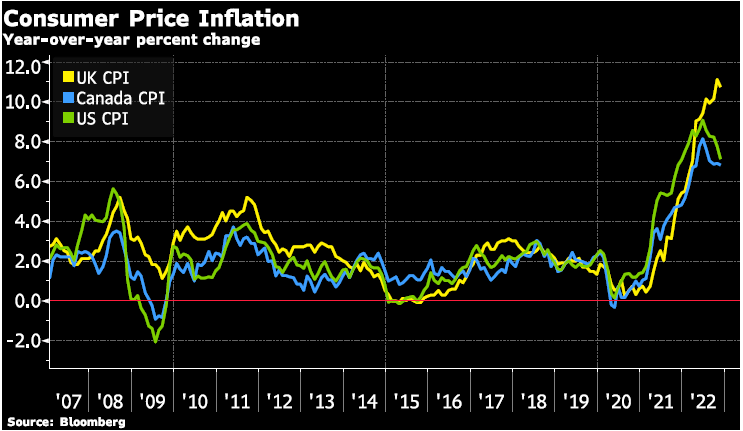

During that decade inflation never showed up in CPI. Their game worked until finally, inflation showed up in 2021 – in a major uptrend! First, they said inflation will pass by without staying so therefore interest rates should stay low and the wealth effect need not be disrupted.

2022 was a huge embarrassment for this ‘wealth effect’ thinking. During the past nine months, central banks hiked interest rates again and again because consumer price inflation had finally arrived, and was not retreating as they had previously said it would.

Although years later this is the same inflation that central bankers first said was good or needed [to combat deflation] and then claimed was transitory [and certainly not a structural mistake on the part of central bankers].

Eventually, after embarrassment their message changed to become ‘interest rates must go higher for longer because we must destroy the wealth effect since that is what causes inflation’.

In other words, central banks are now trying to destroy the demand that they worked so hard to create over the last decade.

Here is Jerome Powell in September 2022 saying stock markets and housing and job losses are exactly what needs to happen next:

Housing is significantly affected by higher rates, which are really back where they were before the global financial crisis. Also, the housing market was very overheated for a couple of years after the pandemic, as demand increased and rates were low. The market needs to get back into a balance between supply and demand.

Do you see what just happened? When bankers wanted inflation they hoped that the mass of people felt wealth so that they would spend money.

But once inflation arrives those central bankers no longer want everyone to feel wealthy and instead, would like them to stop spending in order to control inflation. Now they want to reverse consumers’ feeling of wealth to stop the inflation that they created. Will that work? No one knows!

Do you feel like central banks are just dogs chasing metaphorical hubcaps? In fact, let’s remember the first rule of central banking is – no one knows. Did they keep rates too low for too long? – no one knows.

Did those low rates eventually cause inflation? – no one knows. Was inflation caused instead by terrible government spending decisions and money printing? – no one knows.

Despite no one knowing if it will work, the central bankers now plan to stop inflation by stopping consumers from feeling wealthy.

The only thing we do know is that physical metals are a great way to get off this crazy helter-skelter roller coaster upon which we are all unwitting passengers.

What does the economy have in store during 2023? – no one knows. What central bank machination or belief will be seized upon next? – no one knows. But we all know that refusing to play their rigged game is the best choice so own physical metals.

Yes, no one knows. But failing to plan often is a plan to fail. So, for what it’s worth our current guess is that in 2023 the central bankers will realize they raised rates too far and too fast.

Further, we figure that this wisdom will come to them via some yet unforeseen financial crisis. Somewhere today some huge corporation or hedge fund or government is sitting on hidden leverage that will become a crisis when exposed later this year.

Jerome Powell’s panic moment comes when he cannot lower rates because inflation remains high, but he cannot hold rates steady because financial contagion will result.

Interested to find out more about how to take back control of your wealth? Why not watch GoldCore TV for more discussion, commentary, and interviews with leading experts.

From The Trading

Market Update

The gold price has started 2023 with a nice pop hitting a six-month high in USD terms, climbing to $1,860 with silver joining in too with a move just shy of $24.50.

Price settled at the $1,850 level on the back of the Federal Reserve December meeting minutes that were released yesterday.

Fed officials confirmed their commitment to bringing down inflation and warned against ‘unwarranted’ loosening of financial conditions.

There has been a lot of ‘misperception’ in financial markets around losing and a fed pivot. The minutes noted a slower pace of rate hikes does not mean an easing.

“Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability,” stated the minutes of the December Federal Open Market Committee’s meeting.

The minutes went on to say, “A number of participants emphasized that it would be important to clearly communicate that a slowing in the pace of rate increases was not an indication of any weakening of the Committee’s resolve to achieve its price stability goal or a judgment that inflation was already on a persistent downward path’ and minutes went on to say ‘no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023’

Stock Update

Silver Brittania’s – We have an additional allocation of Silver Britania’s from the Royal Mint for December, with the lowest premium in the market at spot plus 32% for EU storage and delivery and spot plus 39% for UK storage and delivery. Please call our trading desk to avail of this offer. Stock is limited at this reduced premium.

Gold Brittania’s are available again for UK and Irish Investors. Gold Britannia’s start at 5% over Spot and Gold 1oz Bars start at 4.2% over Spot.

GoldCore have excellent stock and availability on all gold coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here